Best Practices

May 14, 2025

TLDR

To protect margins during the 90-day tariff reprieve, ecommerce brands should expedite shipments to avoid higher duties and negotiate cost-sharing with suppliers. Focus on high-margin products, adjust prices strategically, and cut discretionary spending. Optimize supply chains by sourcing outside China and using duty drawbacks. Streamline SKUs to focus on profitable items and renegotiate logistics contracts. Monitor KPIs like gross margin and COGS per unit to assess effectiveness and adjust quickly.

In a sudden trade policy shift, the U.S. and China agreed to pause exorbitant mutual tariffs for 90 days, temporarily lowering U.S. import duties on Chinese goods to 30%. This reprieve followed an unprecedented tariff hike (up to 145%) that had prompted many brands to delay or cancel orders. Although the 30% increase is a relief from the peak, it is still a significant increase that puts pressure on product costs and margins—more than twice the usual Section 301 rates.

Before possible tariff escalation resumes, importers now have a limited 3-month window to bring in goods at 30%. The rush to ship inventory during this window will strain ports and carriers, driving up logistics costs. Companies that manufacture in China and ship domestically need to move quickly to lessen the 30% duty's impact on their margins. These can range from reworking supply chains and speeding up shipments to making changes to pricing, costs, and marketing.

Due to the timing risks of goods arriving after the window closes, retail executives characterize this time as "beyond dangerous." In order to protect margins during this tariff surge, the following sections describe both short-term and long-term levers.

Critical Actions in the 90-Day Window

To preserve margins in the short term, ecommerce brands should execute five urgent actions in the 90-day tariff window (each with expected impact and required effort):

Expedite Inbound Shipments: Front-load imports to U.S. ports before the tariff window ends. By rushing goods out of China at 30% duty (vs. a possible return to 145%), brands avoid a massive cost hit.

Impact: Potential duty savings of 15–20% of COGS if higher tariffs return; prevents stockouts.

Effort: High – requires premium freight bookings and tight coordination with suppliers and 3PLs.

Negotiate Cost Sharing with Suppliers: Renegotiate purchase orders to split the tariff pain. Many Chinese manufacturers, eager to keep orders flowing, may offer temporary discounts (e.g. 5–10%) or extended payment terms.

Impact: Every 5% supplier discount offsets roughly one-sixth of the tariff cost; improves gross margin by several points.

Effort: Medium – rapid sourcing discussions and perhaps volume commitments in exchange.

Optimize SKU Mix and Inventory: Prioritize high-margin and tariff-light products. Delay or drop low-margin SKUs that can’t absorb the 30% duty, and push alternative products or local inventory.

Impact: Preserves overall gross margin – e.g. cutting unprofitable SKUs can boost margins by ~0.5–1%.

Effort: Medium – requires merchandising analysis and nimble inventory planning.

Implement Targeted Price Adjustments: Carefully raise prices or add surcharges on select items to pass on some tariff cost. Consumer goods giants raised prices ~10–15% in 2022 to offset inflation, with modest volume loss (e.g. +15.2% price caused only –4.8% volume for Kraft Heinz).

Impact: Each 1% price increase can add ~0.5–1% to gross profit, helping offset duty costs (though some sales may be lost).

Effort: Low to Medium – requires pricing strategy and monitoring customer response.

Cut Discretionary Spending & Improve Efficiency: Freeze hiring and trim overhead (travel, non-critical projects) to immediately lower SG&A. Simultaneously, streamline fulfillment processes to avoid waste.

Impact: Every $1 saved in overhead directly protects $1 of operating margin. For example, a brand could target a 10% marketing cut – if executed smartly, Stitch Fix saw only a 13% client drop after cutting marketing 40%.

Effort: Medium – internal cost discipline and possibly renegotiating vendor contracts (e.g. 3PL fees).

Each of these actions provides a buffer to margins during the tariff period. For instance, expediting shipments and supplier concessions directly reduce cost of goods sold, while pricing and cost cuts improve revenue or lower expenses. Brands should quantify the benefit (e.g. duty dollars saved, margin % gained) and effort for each, focusing on the highest-impact moves first.

Profitability Levers for Margin Protection

Beyond the immediate tactics, focusing on these five profitability levers will help sustain margins during the tariff spike and beyond.

1. Supply-Chain Efficiency Optimization

Lower your costs by finding suppliers outside China or closer to home. Use trade agreements and duty programs to reduce tariff costs. For products still made in China, ship to special trade zones to delay paying duties, and claim refunds on returned items. This strategy is gaining momentum – 69% of firms planned moves out of China by 2024, up from 55% in 2022 (Bain & Company, 2024).

Key Metrics: Landed cost per unit, gross margin % on product (COGS), tariff spend as % of sales, supply lead time, inventory fill rate. These indicators show if sourcing changes are cutting costs and maintaining stock availability. For duty drawback, track duty refunded ($).

Supply chain efficiency optimization in action:

Premium cooler and drinkware brand YETI mitigated recent tariffs through aggressive supply-chain shifts. By 2024, YETI had moved 20% of production out of China, and it now targets 80% of global drinkware capacity outside China by the end of 2025. This ahead-of-schedule diversification insulated YETI from a new 10% tariff implemented Feb 2025 – the CFO noted the added duty would cost < $10 million that year, thanks to reduced China dependence. YETI also negotiated long-term freight deals. Tariff impact was contained to <1% of revenue, and the company expects a return to double-digit growth in the second half of 2025, crediting its supply shifts for enabling a “robust lineup” without margin erosion (Supply Chain Drive, 2025; JM Rodgers, n.d.).

Impact measurement: You can assess the effects of modifications to your product's cost of goods over time and take appropriate action when required by using our Profit by Product Variant over time report.

2. Pricing & Merchandising Optimization

Pricing and merchandising is entirely up to the brand, so there is a lot of leverage here. Start with the following steps:

Adjust pricing and product assortment to maximize margins:

Raise prices on less price-sensitive SKUs to offset tariff costs.

Streamline the catalog by cutting unprofitable items and focusing on high-turn, profitable SKUs. This reduces complexity and costs across production, inventory, and marketing.

Use pricing power as a margin lever:

Major CPG brands raised prices by 10% with minimal volume loss, demonstrating pricing effectiveness.

Optimize merchandising:

Bundle products to increase average order value.

Adjust pack sizes to manage unit economics under the tariff.

Reduce or redesign heavy or costly-to-import products:

Improve packaging to reduce shipping and import costs.

Reduce size of the product itself to reduce costs.

Adopt a “fewer, bigger, better” SKU approach to protect profit:

SKU reductions have added 65-90 bps to gross margin since 2019.

Further rationalization in 2024 is expected to add another 150-175 bps.

Impact Measurement: Using our Sales by Customer Type over Time report, you can track various sale metrics, including AOV and unit per order over time to estimate how much price changes affect both your new and existing customers’ purchasing patterns.

Key Metrics: Gross margin per SKU, average order value (AOV), units per transaction, percentage of revenue from core (top 20%) SKUs, price elasticity (sales volume change vs. price change). These metrics reveal if pricing changes stick and if the product mix is yielding higher margins. Monitor conversion rate too – a sharp drop may signal prices are too high.

Pricing and merchandizing optimization in action:

Hasbro’s SKU reduction: Hasbro eliminated 50% of its SKUs, focusing on high-value products and cutting low-volume items that generated only 2% of revenue. This move, along with headcount cuts, is expected to save millions and improve operating margins.

Oatly’s profit boost: Oatly reduced 70% of its SKUs in Asia, simplifying operations and driving margin recovery. This strategy helped improve its gross margin after the cuts.

Dollar General’s efficiency gains: Dollar General announced a “meaningful” SKU reduction in 2023 to increase margins and alleviate supply chain challenges. This effort focused on streamlining inventory and improving cost efficiency.

(Modern Retail, 2023; Food Navigator USA, 2023).

3. Logistics & Fulfillment Cost Control

Logistics and fulfillment costs can make many SKUs unviable. Start with these optimizations to cut back where you can:

Optimize logistics to cut fulfillment costs: Use zone-skipping to reduce multi-zone shipping fees and optimize warehouse locations to shorten last-mile distances. Renegotiate contracts with 3PLs and carriers to secure better rates, especially as freight costs have fallen by ~80% since the pandemic peak.

Audit packaging to reduce costs: Review packaging to minimize dimensional weight and avoid wasteful spending. Every ounce or inch saved in parcel dimensions directly lowers shipping costs.

Leverage temporary warehouse capacity: Use temporary warehouse space to manage inventory surges during the tariff window, avoiding port storage fees. This will help maintain margins while managing supply chain challenges.

Key Metrics: Fulfillment cost per order, shipping cost as % of sales, average delivery distance or zones crossed, on-time delivery rate, inventory turnover. Also track customer shipping expense recovery (if charging for shipping) vs. free shipping thresholds. These KPIs ensure cost-cutting measures don’t overly degrade service.

4. Marketing Mix Reallocation

Most brands are already starting with modifying their marketing media mix. This is the lowest hanging fruit, start with the following steps:

Shift spend to high-ROAS channels: Focus on efficient acquisition channels with low or zero marginal cost, such as organic social media, influencer partnerships, email/SMS, loyalty referrals, and SEO/content. Trim low-yield ad spend, like broad Facebook targeting, to get more profit from each marketing dollar.

Diverse marketing strategies: In 2023, many DTC brands moved away from Meta, with four out of six surveyed planning to cut Meta ad spend by up to 30%. They reallocated budgets to TikTok, Google, and affiliate programs to achieve cheaper reach and more attributable sales.

Invest in retention marketing: Engage existing customers with personalized offers or subscriptions, which are more cost-effective than acquiring new customers. Use marketing mix modeling to identify profitable campaigns and ensure a leaner, high-ROAS marketing funnel.

Key Metrics: ROAS (Return on Ad Spend) by channel, Customer Acquisition Cost (CAC), Blended CAC as % of revenue, LTV/CAC ratio, and organic vs. paid traffic mix. Also monitor repeat purchase rate and marketing-driven incremental margin. If ROAS increases and CAC falls, reallocation is working. A high LTV/CAC (e.g. >3:1) indicates sustainable marketing economics.

Impact Measurement: Use our DTC Marketing KPIs over Time report to track important cost and impact metrics over time for all of your marketing channels, including CPC, CTR, CPM, ROAS, and others.

Marketing mix reallocation in action:

e.l.f. Beauty’s viral growth: e.l.f. Beauty saw a 76% sales increase in FY2023, driven by viral TikTok campaigns and influencer engagement with minimal ad spend. The #eyeslipsface challenge, which garnered over 9 billion views, generated sales without proportional marketing costs.

Stitch Fix’s marketing cut: Stitch Fix refocused on its core styling service and reduced marketing spend by 40%, with only a 13% drop in active clients. The savings of tens of millions highlighted the inefficiency of prior ad spend, moving the company closer to breakeven.

(Corq Studio, 2023; Retail Dive, 2024).

5. Customer Profitability Maximization

We work a lot on understanding customer preferences and driving profitability through personalized attention. Start with the following:

Boost customer lifetime value (LTV): Expand subscriptions, memberships, and loyalty programs to encourage repeat purchases and higher retention. Subscription businesses typically see 230% higher LTV than one-off sales models, making it a key strategy for long-term profitability.

Promote products that drive higher LTV: Identify the products that acquire high LTV customers, then promote them in ads and feature them prominently on your website. Your top selling product might not be the product that acquires your best customers.

Implement tiered rewards and targeted marketing: Offer tiered rewards for high-value customers to incentivize more spending (e.g., free gifts, exclusive access). Use data analytics to target high-LTV segments and personalize marketing efforts, maximizing profitability per customer.

Enhance customer service and product quality: Focus on exceptional customer service and product quality to maintain loyalty, even when prices rise. By increasing annual spend and reducing churn, brands can mitigate margin pressure from external costs.

Key Metrics: Customer Lifetime Value (LTV), Repeat purchase rate (e.g. 60-day or 1-year repeat %), Churn rate or active subscriber count, Average order frequency per customer, and Customer Acquisition Payback Period. Also track net promoter score (NPS) or customer satisfaction, as happy customers stick around longer. If LTV rises and churn drops, margin per customer improves over time.

Selecting LTV driving products: The Customer Acquisition and Retention by Product report reveals which products attract the most valuable customers—those who not only make initial purchases but continue placing orders and driving significant sales over time. By identifying the products that bring in high-LTV customers, you can make smarter decisions about which items to promote, ensuring your marketing efforts directly contribute to long-term growth and profitability.

Ulta Beauty’s loyalty program: Ulta’s Ultamate Rewards has 44 million members, driving ~95% of total sales. By capturing customer data and rewarding repeat purchases, Ulta increases frequency and basket size, with loyalty members spending 2x more when linked to Target’s partner program.

Amazon Prime’s customer profitability: Prime members spend $1,400 annually, compared to $600 for non-members. The subscription’s perks, such as free shipping and media content, foster loyalty and increase shopping frequency, boosting Amazon’s margin per customer.

Pacifica Beauty’s intelligent product promotions: Pacifica uses Airboxr’s analysis to identify the products that acquire the best customers, and prominently features them on their website.

Improve your DTC game. Sign up for weekly tips.

Case Studies: Brands Preserving Margin Under Cost Volatility

To illustrate how these levers come together, here are two more examples of brands that successfully protected or improved margins amid tariff or cost turbulence:

Steve Madden: Fashion Footwear Tariff Tactics

Scenario: In 2019 and again in 2024, Steve Madden faced tariff hikes on Chinese-made shoes, with 70% of its goods sourced from China. Tariffs above 25% threatened profit margins.

Actions & Levers: Steve Madden rapidly pivoted its supply chain, cutting Chinese sourcing by 45%, diversifying to factories in Cambodia, Vietnam, Brazil, and Mexico. The company also negotiated cost concessions with Chinese suppliers, built inventory ahead of tariff deadlines, and adjusted product mix by prioritizing tariff-free country-made styles while slightly raising prices on some China-made items.

Outcomes: By 2019, the company mitigated the tariff impact, estimating only a ~2% earnings hit. By 2024, Steve Madden was well-prepared with a flexible strategy, avoiding major price hikes and maintaining steady sales, demonstrating effective use of supply chain and pricing levers. (Supply Chain Dive, 2024)

Hasbro: Cost Reset Amid Inflation and Sales Slump

Scenario: In 2023, Hasbro faced rising costs and a 14% drop in Q4 2022 revenue, with margins under pressure from inflation and slower post-COVID demand.

Actions & Levers: Hasbro launched a margin improvement program, focusing on pricing & merchandising optimization by eliminating 50% of low-profit SKUs, streamlining its product portfolio. The company also reduced costs by laying off 15% of its workforce and consolidating suppliers for volume discounts. Pricing was selectively raised on key toy lines, while marketing spend was reallocated to core franchises and digital channels for better ROI.

Outcomes: By late 2023, Hasbro was on track to save $250M by 2025 and return to revenue growth with a leaner product portfolio. Gross margins stabilized despite lower sales, and the company’s cost structure was significantly improved, preparing Hasbro for a more profitable future. (Modern Retail, 2024)

Weekly KPI Dashboard for Margin Protection

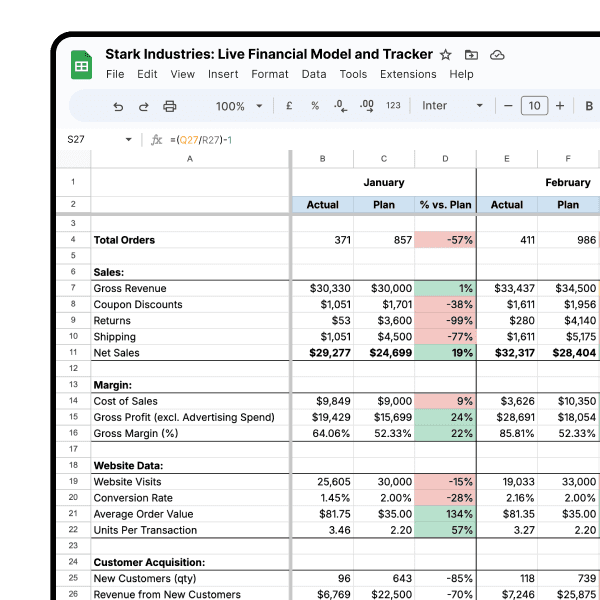

To ensure leadership can monitor progress and react within the 90-day window, a one-page weekly dashboard of key performance indicators (KPIs) should be used. This dashboard tracks both financial outcomes and operational drivers across the five levers:

Gross Margin % (Weekly) – Core metric showing overall product profitability each week. (Target: Maintain within 1–2 points of pre-tariff baseline.)

COGS per Unit (By Category) – Tracks cost of goods sold per unit, revealing if sourcing changes or supplier negotiations are reducing unit costs. (Watch for decreases as new suppliers come online or duty savings realized.)

Import Duty Spend ($) – Total tariffs paid this week vs. pre-tariff expectations. (Goal: minimize this via duty mitigation; report savings from duty drawback or re-routed shipments.)

Inventory Coverage (Days) – How many days of inventory on hand for key SKUs. (Ensure stock building to beat tariff deadline hasn’t created overstock; adjust if >90 days supply.)

In-Transit Containers (# and ETA) – Volume of goods en route from China and % scheduled to arrive before tariff period ends. (KPI for expediting shipments; needs to trend toward 100% before deadline.)

SKU Count (Active SKUs) – Number of active SKUs for sale, tracked weekly. (Should decline if SKU rationalization efforts proceed; each cut SKU should correlate with cost savings.)

Average Order Value (AOV) – Average basket size in dollars. (Aim to increase via bundling or pricing – rising AOV boosts margin per order.)

Fulfillment Cost per Order ($) – All-in fulfillment and shipping cost for an average order. (Target a downward trend from efficiency steps like zone-skipping or new carrier rates.)

On-Time Delivery Rate (%) – Customer orders delivered on time. (Must remain high (>95%) to avoid revenue loss from rush changes; monitor as logistics tweaks are made.)

Marketing ROAS (Overall and by Channel) – Revenue return on each $1 of marketing spend, updated weekly. (Should improve if low-ROAS spend is cut; flag any channel <1.0 ROAS for further adjustment.)

Customer Acquisition Cost (CAC) – Cost to acquire a new customer. (Aim to lower by shifting spend; coupled with ROAS, indicates marketing efficiency.)

Repeat Purchase Rate (%) – Percent of last quarter’s customers who bought again this week (or a cohort repeat metric). (Rising repeat rate suggests loyalty efforts paying off; contributes to margin via lower CAC.)

Active Subscribers/Members – Count of subscription program members or loyalty active users. (Growth here signals success in locking in customers for recurring revenue.)

Customer Churn Rate (% monthly) – For subscriptions or loyalty, the attrition rate. (Should decrease if customer profitability strategies work; stable or falling churn preserves future revenue.)

Review each KPI versus target or prior week. For example, if Gross Margin % slips beyond a threshold, the team can drill down into COGS per unit or duty spend to find cause (e.g. a shipment missed the tariff window). If Fulfillment cost per order isn’t improving, adjust logistics tactics or renegotiate with carriers. This dashboard enables agile management: leadership can see early warning signs (like AOV dropping or CAC spiking) and deploy corrective actions in real time during the 90-day period. It condenses complex operations into an actionable summary – essentially a scorecard of how well margin-protection efforts are working.

With Airboxr, you can build multiple custom reports and feed the data into customizable Looker Dashboard reports to track all key metrics for your business such as a Sales performance, revenue pacing and new customer unit economics.

Top 3 Execution Risks & Mitigation

Even the best plan faces challenges. Keep in mind these three execution risks during your margin protection initiative – and steps to mitigate each:

Risk 1: Supply Chain Disruptions—Rushing orders or switching suppliers quickly could lead to delays, quality issues, or stockouts. Mitigation: Create a contingency plan with backup carriers and expedited shipping for key goods. Stagger imports and keep safety stock of critical items. Test new suppliers with small orders and use foreign trade zones to hold inventory duty-free if needed.

Risk 2: Customer Backlash and Demand Loss—Price hikes or reduced product offerings might upset customers and impact sales. Mitigation: Implement a targeted pricing strategy and communicate any increases as temporary or tied to quality. Offer loyalty rewards to retain customers and ensure substitutes or upgrades for discontinued products. Maintain core marketing and stay engaged with customers to address concerns quickly.

Risk 3: Internal Execution Challenges—Coordinating cross-functional changes could lead to delays or resistance from teams. Mitigation: Set up a “Tariff Task Force” with leaders from all key departments and hold weekly check-ins to track progress. Ensure clear executive support and align team goals with margin targets. Automate processes where possible and have backup plans ready to adjust if needed.

By anticipating these risks and implementing the mitigations, brands can greatly improve the odds that margin protection measures deliver the expected results. Continuous monitoring, quick decision-making, and maintaining customer goodwill are the themes across all these risk responses.

—

The next few months are going to be confusing and frustrating because of the uncertainty. But one thing we do know is that things are not going to be the same anymore—you can’t keep your company in a wait-and-watch mode. If you take the steps above and the tariffs go back down to original levels: you still win because now you have a more profitable brand.